Some Known Incorrect Statements About Fortitude Financial Group

Some Known Incorrect Statements About Fortitude Financial Group

Blog Article

Rumored Buzz on Fortitude Financial Group

Table of ContentsFortitude Financial Group Can Be Fun For EveryoneExamine This Report about Fortitude Financial GroupThe Fortitude Financial Group StatementsFortitude Financial Group for DummiesExamine This Report about Fortitude Financial Group

Essentially, an economic consultant aids people handle their cash. Commonly, there is an investing element to their solutions, but not constantly. Some financial advisors, usually accounting professionals or attorneys who focus on trust funds and estates, are wealth supervisors. One of their key features is protecting customer wide range from the IRS.And after that there are monetary advisors that focus on economic preparation. Generally, their emphasis is on educating clients and giving risk monitoring, capital analysis, retirement preparation, education and learning preparation, spending and much more. To discover a financial expert that serves your area, attempt utilizing SmartAsset's cost-free matching tool. Unlike legal representatives who need to go to law school and pass bench or medical professionals who have to go to clinical school and pass their boards, monetary experts have no specific special demands.

If it's not with an academic program, it's from apprenticing at a financial advising company. As kept in mind earlier, though, several consultants come from other areas.

Or possibly someone who takes care of possessions for a financial investment business determines they prefer to assist individuals and work with the retail side of business. Several monetary consultants, whether they currently have specialist degrees or otherwise, undergo qualification programs for more training. An overall financial consultant accreditation is the licensed economic organizer (CFP), while a sophisticated variation is the legal economic specialist (ChFC).

How Fortitude Financial Group can Save You Time, Stress, and Money.

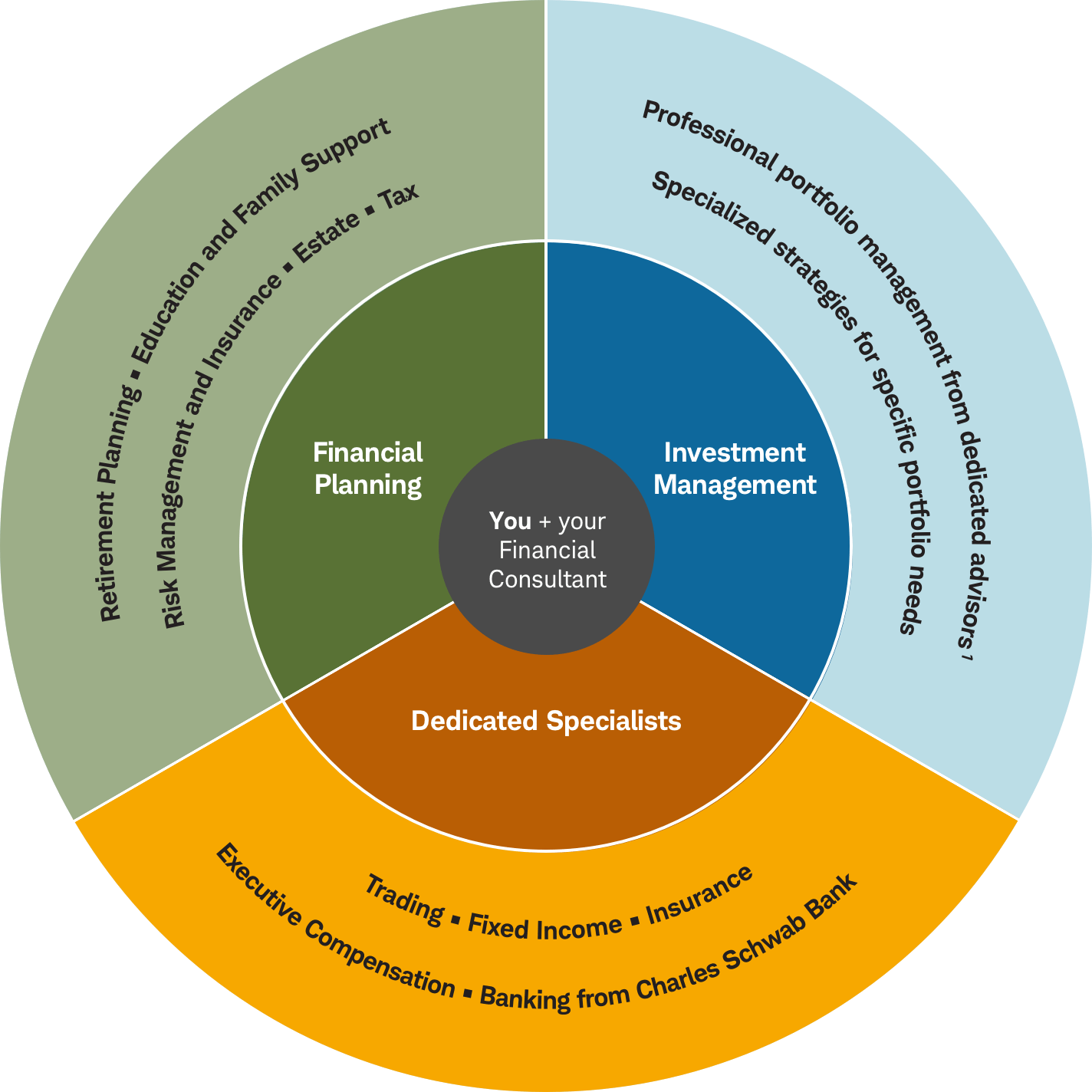

Usually, a monetary advisor provides financial investment monitoring, financial preparation or wide range administration. This can be on a discretionary basis, which suggests the expert has the authority to make trades without your authorization.

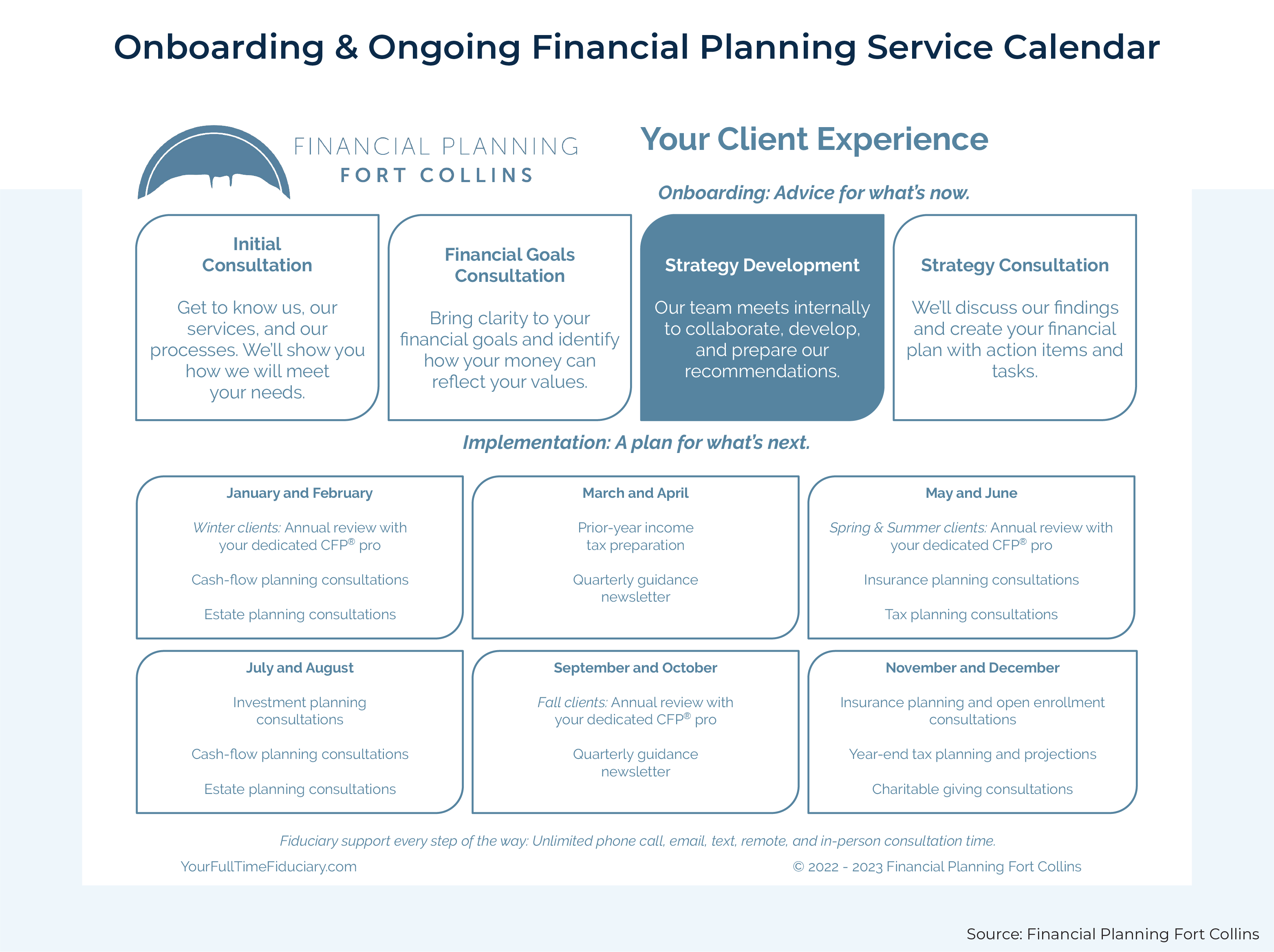

It will certainly detail a collection of actions to take to achieve your monetary objectives, including an investment plan that you can apply by yourself or if you want the consultant's help, you can either hire them to do it once or sign up for continuous administration. Financial Resources in St. Petersburg. Or if you have details requirements, you can work with the advisor for monetary preparation on a task basis

Their names often say all of it: Stocks licenses, on the various other hand, are a lot more regarding the sales side of investing. Financial experts that are also brokers or insurance coverage agents tend to have safeties licenses. If they straight acquire or sell stocks, bonds, insurance products or give monetary advice, they'll require certain licenses associated to those items.

One of the most prominent safeties sales licenses include Series 6 and Series 7 classifications (https://www.indiegogo.com/individuals/38024181). A Series 6 permit permits an economic advisor to sell investment products such as common funds, variable annuities, system investment company (UITs) and some insurance coverage items. The Series 7 permit, or General Securities license (GS), enables an advisor to market most types of protections, like common and participating preferred stocks, bonds, options, packaged investment items and more.

More About Fortitude Financial Group

Constantly make certain to ask about financial experts' cost timetables. A fee-only advisor's sole form of payment is through client-paid costs.

, it's crucial to recognize there are a selection of payment methods they might utilize. (AUM) for handling your cash.

Based upon the aforementioned Advisory HQ research, prices usually range from $120 to $300 per hour, frequently with a cap to just how much you'll pay in total. Financial advisors can make money with a taken care of fee-for-service design. If you want a fundamental economic strategy, you might pay a level cost to get one, with the Advisory HQ study showing average prices differing from $7,500 to $55,000, depending upon your possession rate.

Indicators on Fortitude Financial Group You Should Know

When an advisor, such as a broker-dealer, sells you a monetary item, he or she obtains a certain portion of the sale amount. Some economic specialists who help huge brokerage companies, such as Charles Schwab or Integrity, receive an income from their company. Whether you require a monetary advisor or not depends upon exactly how much you have in possessions.

Report this page